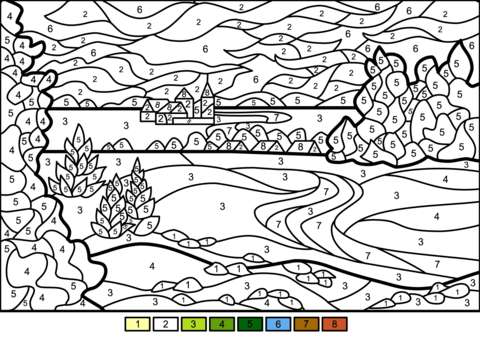

Pitch Templates are Paint By Numbers Kits

Why coloring outside the lines will help you raise more money

Pitching is storytelling. When raising capital, I encourage early-stage founders to worry less about what investors look for or what we typically see. A great pitch doesn’t fit a business to a template. It pulls the audience in and evokes emotions about the business. Your multi-million-dollar pitch is your story. Focus on your narrative, play to your strengths, and reach beyond what everyone else is doing.

“I've learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.”

– Maya Angelou

Focus on your narrative

Every investor has different deck and pitch preferences, but we all know a good pitch when we see one. It’s not because the founder checked every box from an ideal template or because we learned everything we expected to learn. When I think back on the best pitches I’ve witnessed, what stands out the most is a feeling.

Sometimes you sit up in your chair, as if the founder is physically pulling you toward their higher purpose. Other times you wriggle in your seat, antsy to start digging deeper into the product. You may feel your eyes grow wide and your mouth drop as you begin to realize the potential of a new business model.

The specifics of what evokes these feelings are unique, but what’s true for all memorable pitches is the presence of a compelling narrative. Conversely, you can always tell when you’re reading a deck that simply fills in the sections of a template like Paint By Numbers.

Instead of anticipating what investors want, paint the picture that makes you shine. Why are you on this ten-year journey? What beliefs about your customer, market or product excite you every day? Why can’t you imagine working on anything else? Whatever you feel when you ask yourself these questions is the feeling you want to leave investors with. Channel Maya Angelou and make investors remember how you made them feel.

Play to your strengths

One of the best pitches I’ve ever seen was delivered with a black-and-white pitch deck in Google Slides by two serial entrepreneurs who successfully exited their previous startups. They raised $15M using simple slides featuring the default font, no formatting, and zero images and graphs.

Yes, this team was uniquely backable and many people don’t have the luxury of touting previous exits. Still, raising $15M in Seed financing at the valuation they were targeting was a stretch even for them, and many firms passed.

One reason they were successful is that they played to their strengths. Everyone knew they could execute on visual identity and brand so they didn’t waste time on it for the deck. Everyone knew they had scaled large businesses so they didn’t make slides on the use of funds. There was no competition slide with a 2x2 nor a market slide with concentric circles for TAM, SAM and SOM.

The key to their pitch was helping investors understand the novel product they were pioneering. They explained the business model, the product roadmap, the customer experience, the legal considerations, and everything else we needed to know as people considering the idea for the first time. They focused entirely on making this new concept black and white (literally) and stripped away anything that wasn’t critical.

Reach beyond what everyone else is doing

I realize a template pitch deck can frame your thinking. Having a perspective on your business through that lens is prudent. As we see with influential artists, musicians and chefs, mastering the fundamentals is critical to thinking outside the box and creating novel ideas. The Problem, Solution, “Why now?”, Market, Competition, Product, Business Model and Team are your fundamentals, but knowing them is the beginning, not the end of the process.

If you build your deck using the same template everyone else uses, you risk looking like everyone else. That’s the opposite of what you want. When crafting your pitch, your goal is to stand out from the crowd.

These tweets about customer acquisition costs illustrate this well. When acquiring customers, the goal is not to optimize against an industry standard—success would only help you edge out your competition. What you’re after is the lowest CAC possible—that’s how you blow the competition away.

The same can be said of your deck. Don’t benchmark to the mean and show what everyone else shows. Reach beyond the template and tell the best version of your company’s story.

Stories drive the business forward

Practically speaking, a memorable story matters in fundraising because part of our jobs as investors is telling your story for you. To move a deal forward with our partners, we tell your story. When the investment committee meets, the story is what frames the discussion. If investors are piecing together your narrative themselves, you’ve already lost.

Storytelling is also a critical skill outside of fundraising. As you build your business you’re going to hire unaffordable outliers by connecting them to your stories. Your first customers will take a chance on your unfinished product because of how you narrate your vision. Storytelling is important whether you’re a public company or a startup, but it’s especially valuable early, when so much is yet to be written.

I’ve learned from sharing these ideas with founders that many people give them the opposite advice, advising them to stick to the template and make it easy for investors to run a deck through their mental models. I understand this perspective, and I think you can have it both ways.

I’m not saying ignore the things that inevitably come up in pitches. You need to know your unit economics, competitive positioning, market size, etc. What I’m suggesting is to focus on the most compelling narrative of your business. You can always put the rest in the appendix and voice it over in the Q&A or follow up with a data room. In my experience, what’s more common than missing information is a missing narrative.

I’m also not saying make a fluffy deck. If you’re a year into operations and ARR is $2M with 50% MoM growth and negative churn, the numbers are probably your best story. As the business matures, traction will become even more central. The point is not to muddy the narrative with less important slides when you clearly have product-market fit.

Find the right partners

I also often hear a desire to make comprehensive slides because you never know who might resonate with which part of the deck. I’m told that good opportunities are hard to come by, so it’s important to cover all your bases and make the most of every one.

I think this makes fundraising feel like selling widgets when a better approach is partnership development. Rather than treat every opportunity as the chance to close an important sale, consider shifting your perspective to finding the right partners for the business. You never know who is looking for exactly what you’re doing, and fundraising is the process of finding those people, not convincing everyone else.

This applies to both sides of the table. I know most companies won’t fit exactly what I’m looking for, and even when they do, I won’t always have the opportunity to invest. All I can do is focus on my story and play to my strengths. It won’t always be a match, but it doesn’t need to be. You just need to find the ones who really believe.

Want to add an egg? [Optional footnote]

This little bit extra is a few quality resources to help you actually craft a pitch.

How to Build Your Seed Round Pitch Deck

(Aaron Harris, Y Combinator)

"Pencil and Notepad" Slide Deck process that got my company $8.5M in a bear market

(Gui Laliberte, LinkedIn)

Writing a Business Plan

(Sequoia Capital)

Fundraising? Why you shouldn’t just copy Sequoia’s Pitch Deck Template

(Scott Sage, Medium)

30 Legendary Startup Pitch Decks and What You Can Learn From Them

(Aaron Lee, Piktochart)