Platform as a Product

Sharing my talk from the 4th Annual VC Platform Summit

This was originally posted on Medium. All of my writing is now here at addtheegg.com.

This is a summary of the short talk I gave at the 4th Annual VC Platform Summit in New York. I hope this helps you understand the role of platform at Crosscut, why we approach it like a product, and how we execute.

You can find the full presentation slides here.

My entry into “product” was at a seed-stage mobile ad tech startup called Thinaire. After shifting responsibilities from finance to business development on our fifteen-person team, I suddenly found myself gathering requirements from our enterprise customers and prioritizing them for our engineers.

I didn’t even know this was called product until I explained it one day to a friend. Fortunately, she was a technical project manager on the engineering team at Warby Parker. She not only helped me understand my role but also encouraged me to join her at the company in 2014. Thankfully, I did.

My approach to building the platform at Crosscut reflects experiences from my time managing the Home Try-On program at Warby Parker. My goal is to share a few lessons and leave you with these three things:

A framework for building a venture capital platform like a product

A model product roadmap

Questions to keep the conversation going

Platform as a product

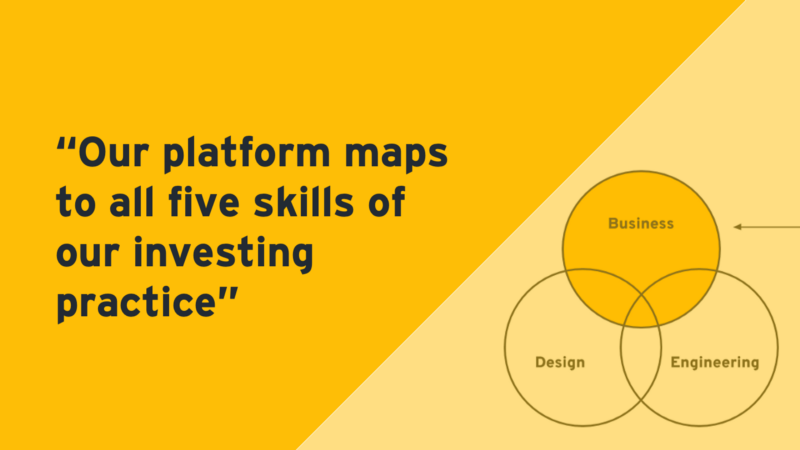

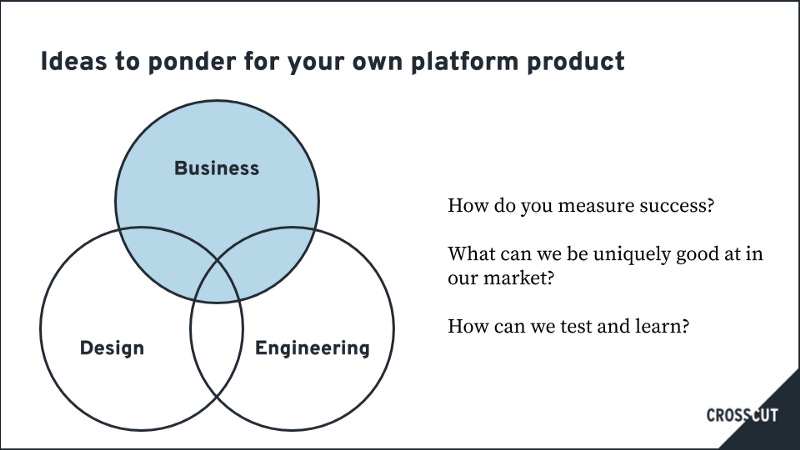

Product is often said to be at the intersection of business, design, and engineering. Every successful product manager must have fluency in each practice, especially in the trade-offs and decision-making criteria considered by the stakeholders within them. PMs may be stronger in one or two areas, but it’s essential that they can navigate all three.

Unknown business, design and engineering challenges will inevitably change the scope and requirements of the product. It’s the PM’s job to balance competing priorities and ship products that serve the business, meet the needs of users, and optimize the use of limited design and engineering resources. For now, we will focus on the business problem.

(We breezed through an overview of product management. You can learn more about what makes a successful PM here, here, and here.)

The business problem

Building our platform like a product starts with answering three questions:

What are the goals of the business?

How do products serve those goals?

How do you prioritize?

What are the goals of the business?

In venture capital, it’s simple: to maximize returns.

How do products serve those goals?

When I entered my role, I often heard people talk about platform as post-investment support for the portfolio. We’ve determined this doesn’t work for Crosscut. It highlights an investor’s job as the work leading up to making an investment and downplays all that’s done afterward.

Our general partners work closely with founders to help them grow their businesses, manage their capitalization, extinguish existential fires, and in the best cases, capture the value they’ve created together. These are critical parts of our firm’s partnership with founders, and our managing directors would never say their jobs stop when the check is written.

At Crosscut, our platform maps to all five skills of our investing practice, serving as the foundation that makes us all better investors. For sourcing, we might use automation to better manage the complex, interconnected network at the top of our funnel. In picking, we might implement a firm-wide pre-vote for all in-person pitch meetings, allowing investors to gather their thoughts before biasing the conversation with whatever the first speaker decides to bring up. (Thank you, Dorm Room Fund.)

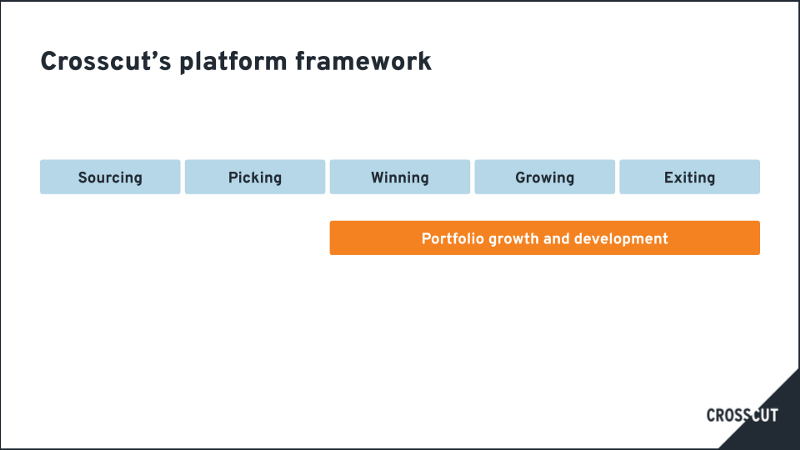

Neither of these activities would be considered post-investment support for the portfolio. So, we organize our platform into three core functions:

Portfolio growth and development

Marketing and community

Investing operations

Portfolio growth and development

This is how we help build our portfolio companies. We create solutions for talent acquisition, business development and fundraising because all of our companies need them at their early stages. We also jump at opportunities to debate go-to-market plans, brainstorm product strategy or develop pricing frameworks in workshop-style sessions. This work is straightforward: we drive greater returns by growing better companies faster.

Marketing and community

Our story is the collection of our portfolio companies’ stories. We believe that amplifying their voices helps our founders find opportunities for growth while helping other founders and operators better understand what we’re looking for in founding teams.

If marketing is our commitment to storytelling, then community is our commitment to cultivating relationships across the tech ecosystem. Ever since Rick, Brian, and Brett founded Crosscut in 2008, they have convened people to help the LA market grow. We’re committed to continuing that legacy.

Investing operations

Our team eats its own dog food. We encourage founders to engage in vision-building, goal-setting and strategic planning to systematically manage the priorities of the business, so we do the same ourselves. We encourage them to hire executive coaches, so we’ve done the same ourselves. We believe in testing ideas, learning and growing, so we apply an iterative product mindset to our investment decision-making process, improving not only who we invest in, but how we invest as well. We track outcomes, but we believe building the right processes in our investing operations will produce better ones.

How do you prioritize?

At Crosscut, one of our platform challenges is working with multiple partners who may each be focused on different investment activities at any given time. Like all VCs, we also have limited ways to measure outcomes because of the long feedback cycles in early-stage investing.

Our solution

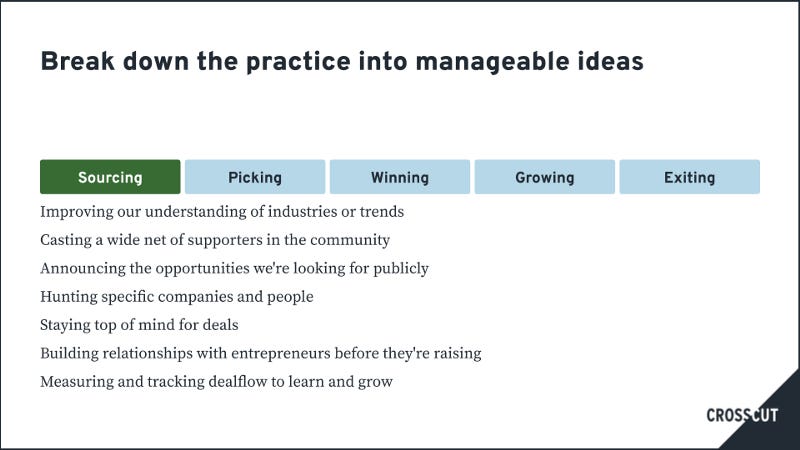

Break down the investing practice into manageable ideas

Pit the ideas against each other as a team

Create a team-wide prioritization model

Let’s use sourcing as an example to start the build-up of this model.

This is an illustrative list of the types of impact that projects might have on our sourcing funnel. Notice they are not discrete projects, but rather larger efforts that have an impact on our sourcing. This is critical for our model. It allows us to debate how important these things are without muddying the conversation with the effectiveness of an individual project.

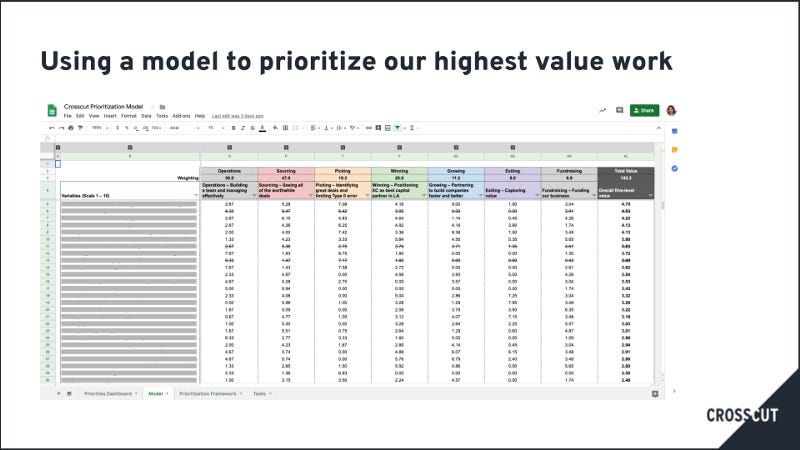

Once we agree upon these elements within each investing practice, the next step is understanding everyone’s views of the relative importance between each of the sub-practices. This slide shows what one response might be.

We use a 1–10 scale to quantify every team member’s perspective on the relative importance of our ideas. It gives everyone a voice, incorporating our intuition and diverse experiences to show us all how we collectively view our priorities. It also helps us commit to them because we’ve set them together.

Inspired by the Warbles Process

The idea to quantify each stakeholder’s views of the highest priorities using points is partially inspired by the former Warbles process (RIP) at Warby Parker.

Putting it all together

Increased fidelity allows us to evaluate how our projects impact our investing practice with more specificity. For example, how might building an advisory board of CTOs drive our returns? On one hand, we can connect the experts to Crosscut portfolio companies to help them grow, and on the other, those same experts can help with diligence on live deals. Engaging this bench of advisors may also keep Crosscut top of mind when the leaders discover founders who are raising equity. Understanding how our team believes this project affects our investing practice allows us to properly prioritize it against other projects as varied as building an internship program or launching a CEO summit.

An important note: the process of building this model is far more important than the model itself. One of the attendees asked me if I would share it, and I reflexively responded that I wouldn’t without a good reason why. It hit me a few hours later: using our model would simply help you sort out how Crosscut should prioritize. Every firm is different — fund size, market, strategy, partnership, strengths, weaknesses, etc. all play a part in prioritization — and my model is almost useless to any fund that isn’t Crosscut.

A simplified product roadmap

We’ve established how our platform products serve the goals of our business and developed a firm-wide prioritization model that allows us to allocate our resources to the highest value work. Now, it’s time to put it all together.

This slide provides a sample visual representation of a product roadmap, but it’s more of a summary. In reality, our product roadmap is a combination of two living documents:

Our 2019 strategy deck that outlines our vision, the goals for the year, the projects we will complete to achieve the goals, and the quarters in which we will focus our attention on them.

Our quarterly product roadmap that breaks the projects down into smaller pieces, captures tasks and owners that we assign at our partner meetings, and the deadlines we’re managing toward.

Creating and executing against a product roadmap will help you accomplish more and ensure that the needs of the business are regularly revisited as you build. It will also keep you honest about what’s possible. Tracking helps us learn the limitations of our resourcing and the improvements we can make to build more effectively.

Further questions

I hope this approach gives you ideas for your own products or platforms. To wrap up, I’ll leave you with a few more questions to consider as you build.

Thank you

I’ve learned a tremendous amount from the VC Platform community while building the investing platform at Crosscut, and it was rewarding to share this perspective with the group. Thank you to everyone who joined my breakout session and for the thoughtful questions.

Let’s continue the conversation @nickbkim.

The VC Platform Community is a self-organized group led by these awesome individuals across the world. We’re very grateful for what you do.

If you’re interested in joining this community or want to learn more, visit:

VC Platform Global Community

This community is constantly evolving with more content and resources added weekly. While you’re here, make sure you…www.vcplatform.com